Evolution of Banking System in India – History of Banking In India

Introduce of Indian Banking hisotry

Banking is considered to be the”Backbone of a Country’s Economy”. Indian Banking, today, is split into commercial banks that are Private, public scheduled, and non-scheduled banks, Regional and Rural, and Cooperative Banks.

Banking Companies Act of 1949 defined banking as accepting for the purpose of investment or lending of depositing money from the public, repayable on demand or otherwise, and withdrawable by cheque draft or otherwise. Let us know more about the History of the Banking System in India.

History of Indian Banking hisotry System in India

The Banking business in India has seen a lot of transitions and changes over the decades. It could be broadly categorized into 3 sub-parts that are:

- Pre-Independence (Before 1947)

- II Phase (1947 to 1991)

- III Stage (1991 and past ).

Banking throughout Pre-Independence (1770 to 1947)

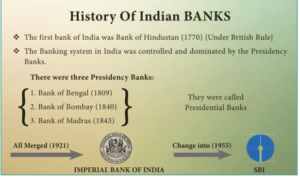

There have been numerous banks created during this time. The Banking System in India began with the establishment of the Bank of Hindustan in 1770 however, it stopped working by 1832.

In this time, over 600 banks have been established. But, very few were able to succeed. Some of the banks were

- Bank of Madras (1843)

- Bank of Bombay (1840)

- Bank of Bengal (1809)

- The General Bank of India (1786-1791)

- Oudh Commercial Bank (1881-1958)

This phase also observed the alliance of the 3 Main banks Bank of Bengal, Bank of Madras, and Bank of Bombay established by The East India Company. They together amalgamated and formed the Imperial Bank. This was taken over by the SBI (State Bank of India) in 1955.

Other Banks which were established during this time were Allahabad Bank (est. 1865), Punjab National Bank (est. 1894), Bank of India (est. 1906), Bank of Baroda (est. 1908), and Central Bank of India (est. 1911).

The reasons why many Significant banks failed to survive throughout the pre-independence interval, the following conclusions can be drawn:

- Indian account holders had become fraud-prone.

- Insufficient machines and technology.

- Human mistakes & time-consuming.

- Fewer facilities.

- Lack of suitable management skills.

Following the Pre-Independence interval was the post-independence period which detected some significant changes in the banking industry scenario and has to date developed a lot.

Indian Banking II Phase — Independence Post Indian Banking (1947 to 1991)

The then Government — after Indian Independence, chose to nationalize the Banks since all the major banks were led individually which was a cause of concern as people in the rural regions still turned to money lenders for assistance.

S.NO. |

Bank Name |

1 |

Allahabad Bank |

2 |

Bank of India |

3 |

Bank of Baroda |

4 |

Central Bank of India |

5 |

Bank of Maharashtra |

6 |

Canara Bank |

7 |

Dena Bank |

8 |

Indian Overseas Bank |

9 |

Indian Bank |

10 |

Punjab National Bank |

11 |

Syndicate Bank |

12 |

Union Bank of India |

13 |

United Bank |

14 |

UCO Bank |

Back in 1980, 6 additional banks were nationalized that are:

| S.NO | Nationalized Bank Name |

| 1 | Andhra Bank |

| 2 | Corporation Bank |

| 3 | New Bank of India |

| 4 | Oriental Bank of Comm. |

| 5 | Punjab & Sind Bank |

| 6 | Vijaya Bank |

Seven subsidiaries of all SBI which were nationalized in 1959:

| S. NO. | SBI NATIONALIZED BANK NAME |

| 1 | State Bank of Patiala |

| 2 | State Bank of Hyderabad |

| 3 | State Bank of Bikaner & Jaipur |

| 4 | State Bank of Mysore |

| 5 | State Bank of Travancore |

| 6 | State Bank of Saurashtra |

| 7 | State Bank of Indore |

All these banks have been later merged with the State Bank of India in 2017, except for the State Bank of Saurashtra, which was merged in 2008. State Bank of Indore was merged in 2010.

Impact of Nationalisation on Banking System

There were several reasons for nationalism from the banks of India that are:

- Nationalism led to an increase in capital and thereby increased the financial state of the country.

- It increased efficiency.

- It helped in fostering the rural and agricultural industry of the nation.

- This opened a major employment opportunity for the people.

- The profit obtained by Catholics used by the Government for the improvement of those people.

- The contest was decreased and work efficiency had improved.

The post-independence stage was the one that led to the major evolution of the banking sector in India.

III Stage of Indian banks (1991 to past )

To Give stability and profitability to the Nationalised Public sector Banks, the Government decided to set up a committee under the leadership of Shri. M Narasimham to manage the various reforms in the Indian banking market.

The biggest growth was the introduction of Personal sector banks in India. RBI gave license to 10 Personal sector banks to establish themselves in the country.

S. NO. |

III Stage of Indian banks |

1 |

Global Trust Bank |

2 |

ICICI Bank |

3 |

HDFC Bank |

4 |

Axis Bank |

5 |

Bank of Punjab |

6 |

IndusInd Bank |

7 |

Centurion Bank |

8 |

IDBI Bank |

9 |

Times Bank |

10 |

Development Credit Bank |

A vast majority of Indian citizens shifted to the internet or internet banking.

1. List of Private Sector Banks and Public Sector Banks in India are:

| S. NO. | Private and Public Bank Name |

| 1 | Axis Bank |

| 2 | Bank of Baroda |

| 3 | Bank of India |

| 4 | Bandhan Bank |

| 5 | Bank of Maharashtra |

| 6 | Canara Bank |

| 7 | Central Bank of India |

| 8 | City Union Bank |

| 9 | Dhanlaxmi Bank |

| 10 | Federal Bank |

| 11 | HDFC Bank |

| 12 | IDBI Bank |

| 13 | Indian Bank |

| 14 | Indian Overseas Bank |

| 15 | ICICI Bank |

| 16 | IDFC Bank |

| 17 | Indusind Bank |

| 18 | Karnataka Bank |

| 19 | Karur Vysya Bank |

| 20 | Kotak Mahindra Bank |

| 21 | Lakshmi Vilas Bank |

| 22 | Punjab National Bank |

| 23 | Punjab & Sind Bank |

| 24 | RBL Bank |

| 25 | State Bank of India |

| 26 | South Indian Bank |

| 27 | UCO Bank |

| 28 | Union Bank of India |

| 29 | Yes Bank |

2. List of Small Finance Banks in India:

| S. NO. |

Small Finance Banks |

| 1 | Capital Small Finance Bank |

| 2 | Equitas Small Finance Bank |

| 3 | Utkarsh Small Finance Bank |

| 4 | Suryoday Small Finance Bank |

| 5 | Ujjivan Small Finance Bank |

| 6 | ESAF Small Finance Bank |

| 7 | Au Small Finance Bank |

| 8 | Fincare Small Finance Bank |

| 9 | North East Small Finance Bank |

| 10 | Jana Small Finance Bank |

3. List of India payment banks:

| S. NO. |

India payment banks |

| 1 | Airtel Payment Bank Ltd. |

| 2 | Paytm Payments Bank |

| 3 | Fino Payments Bank |

| 4 | Jio Payments Bank |

| 5 | Aditya Birla Idea Payments Bank |

| 6 | India Post Payment Bank |